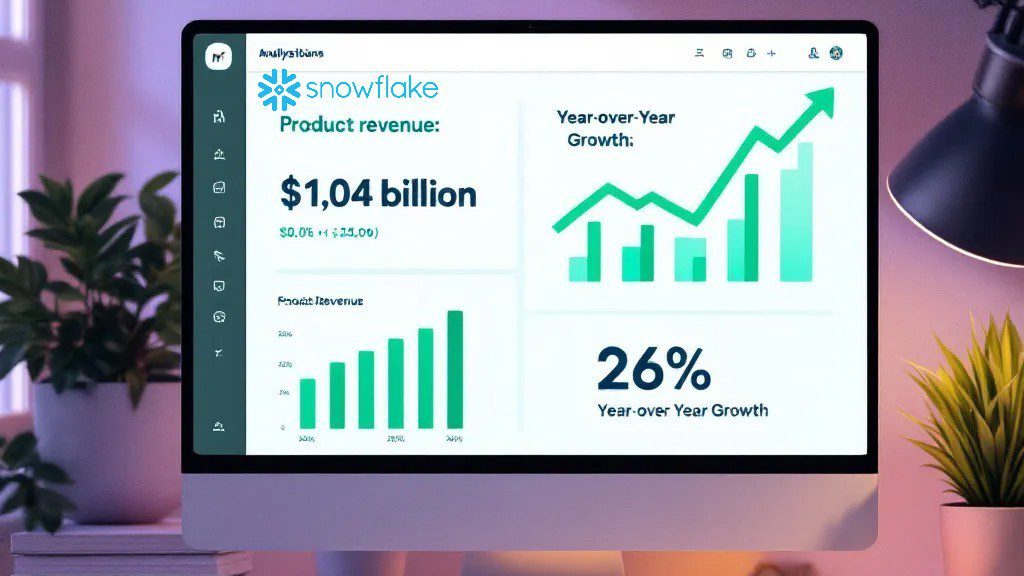

Snowflake shares surged on Thursday following the data analytics company’s announcement of better-than-expected earnings and revenue that exceeded $1 billion, sparking significant investor interest in understanding the driving forces behind this remarkable financial performance.

The cloud-based data platform company delivered impressive quarterly results that beat analysts’ expectations across key metrics. Product revenue reached $1.04 billion representing a robust 26% year-over-year growth that demonstrated the company’s ability to maintain strong momentum in a competitive market.

Snowflake’s exceptional performance stems from its innovative approach to integrating artificial intelligence into its data cloud platform. This strategic focus has proven instrumental in attracting new customers and driving sustained growth across multiple business verticals, particularly in financial services and technology sectors.

The company has successfully expanded its customer base whilst increasing revenue from existing clients. Large enterprise customers have contributed significantly to sequential revenue growth, with many organisations recognising the value proposition of Snowflake’s comprehensive data analytics solutions.

Chief Executive Officer Sridhar Ramaswamy highlighted the transformative potential of artificial intelligence within the company’s strategic framework. He emphasised that the combination of Snowflake’s platform and AI innovations presents substantial opportunities to deliver enhanced value to customers across diverse industries.

The company’s market position has strengthened considerably, with more than 11,000 companies globally now utilising its AI Data Cloud to build, deploy, and share data applications. This extensive customer base reflects growing enterprise demand for sophisticated data analytics capabilities that can support complex business operations.

Snowflake’s financial resilience has been particularly noteworthy given the challenging economic environment. The company has managed to deliver strong earnings and revenue growth despite facing rising operational costs and widening losses, demonstrating effective strategic positioning within the competitive cloud services market.

The emphasis on new AI products and refined customer acquisition strategies is expected to generate more substantial impact in future quarters. This forward-looking approach positions Snowflake to capitalise on the increasing integration of artificial intelligence across business operations worldwide.

The broader implications of Snowflake’s success extend well beyond its immediate financial performance. The company’s ability to drive innovation within the data analytics sector carries significant ramifications for industries that depend heavily on data-driven insights for strategic decision-making and operational efficiency.

As artificial intelligence continues to assume a more prominent role in business operations across sectors, Snowflake’s established leadership position in AI data cloud solutions creates substantial potential for sustained future growth. The company’s comprehensive platform addresses evolving enterprise needs for sophisticated data management and analytics capabilities.

The financial services and technology verticals have emerged as particularly strong growth drivers for Snowflake. These sectors’ increasing reliance on real-time data analytics and AI-powered insights has created substantial demand for the company’s specialised cloud-based solutions.

Market analysts view Snowflake’s performance as indicative of broader trends within the cloud computing and data analytics industries. The company’s ability to consistently exceed expectations whilst expanding its technological capabilities suggests strong positioning for continued market leadership.

The surge in Snowflake’s share price reflects investor confidence in the company’s strategic direction and execution capabilities. The combination of strong financial results and clear growth trajectory has reinforced market optimism about the company’s prospects in an increasingly data-driven business environment.

Looking ahead, Snowflake’s focus on artificial intelligence integration and platform innovation appears well-aligned with evolving market demands. The company’s ability to deliver measurable value to its extensive customer base whilst maintaining robust growth metrics positions it favourably for continued success in the rapidly evolving technological landscape.

News Source: https://www.cnbc.com/2025/05/22/snowflake-shares-earnings.html