It was clear from the beginning that AI would revolutionize the tech industry. We understood it would disrupt the existing order and lead to significant transformations. Yet, during the early days of AI’s emergence into mainstream awareness, many believed it would primarily displace a handful of jobs while creating some new roles, offering students innovative methods to tackle tests and assignments, and introducing a fresh array of tools to enhance productivity and streamline their work processes.

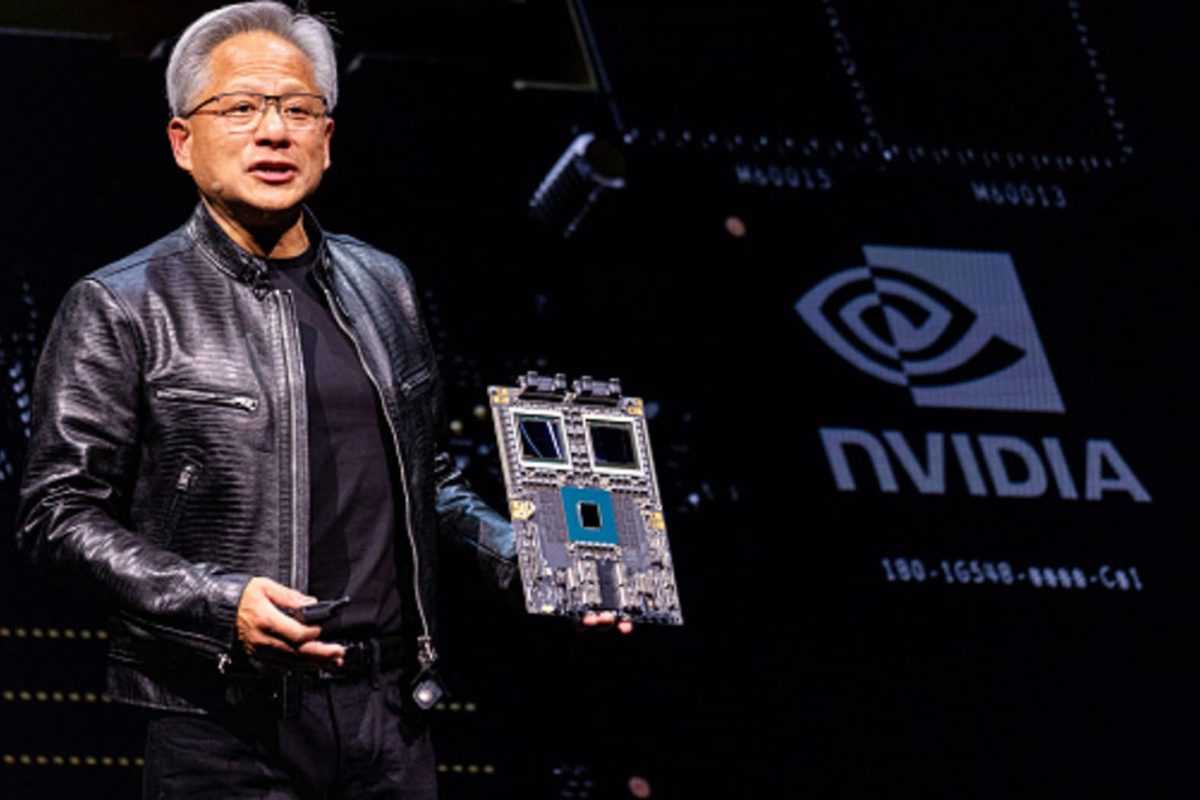

And while most of that remains true, no one could have imagined just how well it would have turned out for Nvidia. Before the AI boom of 2023, that saw Nvidia shot up in its valuation. The company was simply known for producing graphics cards for PC gamers who needed more graphical power to play their favourite games. However, all of that has changed and Nvidia is now the most valuable company in the world. Everyone going into AI is beholden to Nvidia and their graphics cards that make all the large language models we see today possible, even Chatgpt.

So, while most people were playing around with Chatgpt and asking it a bunch of crazy questions trying to break it. They should have been asking one simple question; how do I buy Nvidia stocks before they blast off into outer space?

How has finally gotten Nvidia over the line?

Now, while this jump to the top may have seemed out of the blue to those not well-versed in the stock market, those who are in the know, have been closely watching Nvidia. Waiting for the moment when Nvidia would finally surpass Apple and claim top stop for more than 24hrs.

Make no mistake Nvidia has passed Apple a few time but not for any considerable margin and not for any prolonged period. However, the time has finally come.

On Tuesday, Nvidia surpassed Apple in market capitalization, reclaiming its title as the world’s most valuable publicly traded company for the second time. Nvidia’s stock surged nearly 3%, resulting in a market cap of $3.43 trillion, compared to Apple’s $3.4 trillion. In 2024 alone, Nvidia shares have nearly tripled, reflecting strong investor confidence in the company’s ability to sustain impressive growth driven by its graphics processing units (GPUs) and its leading role in the artificial intelligence sector.

Meanwhile, Apple’s stock has increased by about 17% this year. Analysts suggest that the recent introduction of the Apple Intelligence suite for iPhones could boost sales and position Apple as a leader in “edge AI,” which minimizes reliance on GPU-based servers. Nvidia remains the primary supplier of GPUs essential for creating and deploying advanced AI applications, like OpenAI’s ChatGPT. Over the past five years, Nvidia’s stock has skyrocketed over 2,700%, and its revenue has more than doubled in each of the past five quarters, with three of those quarters seeing a tripling of revenue.

Nvidia rose nearly 3% to close with a market cap of $3.43 trillion, ahead of Apple at $3.4 trillion. Nvidia shares have almost tripled in 2024, as investors show continued confidence in the company’s ability to maintain a rapid growth rate from its graphics processing units, or GPUs, and a leadership position in the artificial intelligence market.

Apple shares are up about 17% this year, although many analysts say the recent release of the Apple Intelligence suite of features for iPhones could drive increased sales and put the company in a leadership position in “edge AI,” which relies less on GPU-based servers.

Nvidia is the dominant supplier of GPUs, which are used to develop and deploy advanced AI software such as OpenAI’s ChatGPT. Its stock is now up more than 2,700% in the past five years, and revenue has more than doubled in each of the past five quarters, tripling in three of them.

Apple made history as the first company to achieve both a $1 trillion and a $2 trillion market cap. Nvidia surpassed Apple in market capitalization last June before experiencing a decline over the summer. Currently, Microsoft holds the third position with a market cap nearing $3.1 trillion, and it relies heavily on Nvidia GPUs to support its partnership with OpenAI and advance its own AI initiatives.

Founded in 1991 to create chips for 3D gaming, Nvidia has recently soared in prominence for an entirely different reason. Over the past decade, scientists and researchers uncovered that Nvidia’s chip designs, originally intended for rendering graphics, were exceptionally well-suited for the parallel processing demands of artificial intelligence.

Subsequently, Nvidia developed specialized software and more powerful chips tailored for AI applications. Last week, Apple reported a 6% revenue increase for the most recent quarter; however, it indicated slower growth than analysts had anticipated for the upcoming period.

Nvidia is set to announce its results on November 20. Additionally, S&P Dow Jones revealed that Nvidia will join the Dow Industrial Average this Friday, replacing long-time competitor Intel and joining Apple within the esteemed blue-chip index.

Source: CNBC