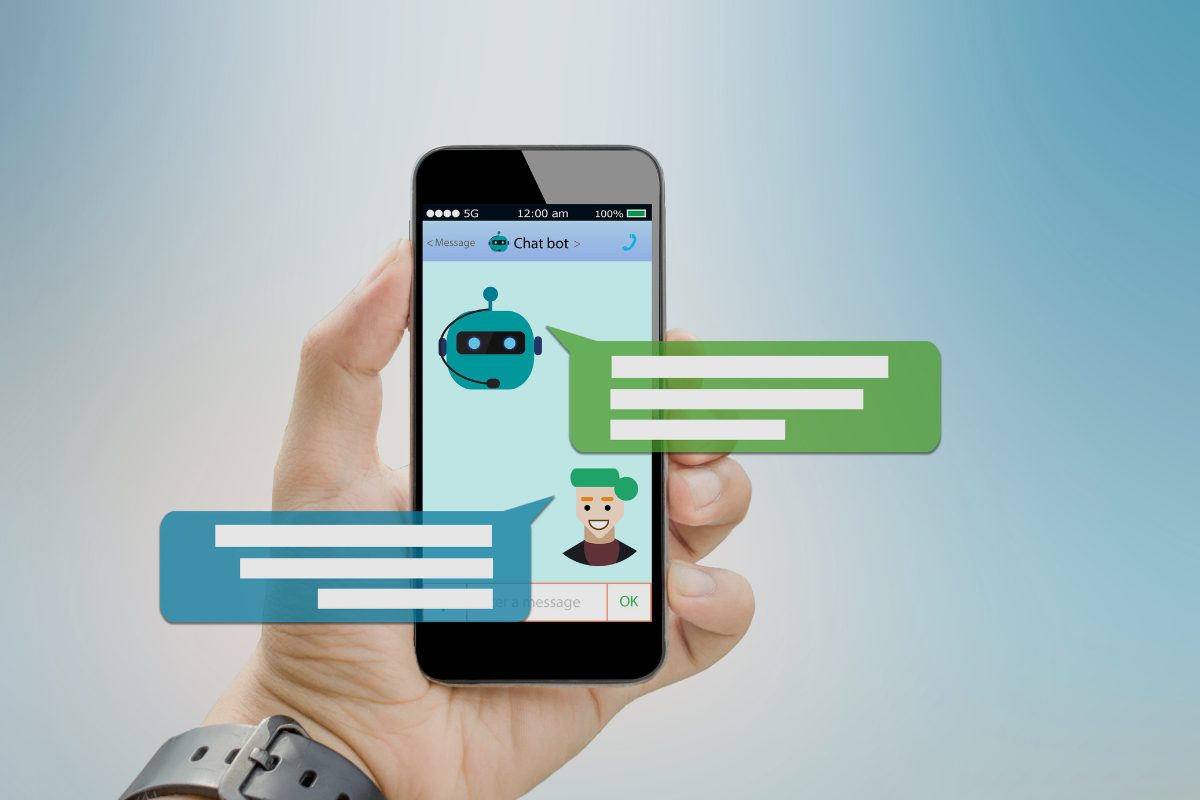

In a significant shift for the financial services industry, AI-powered chatbots and virtual assistants are rapidly transforming banking customer service, with adoption rates more than doubling from 25% to 60% over the past year. Temenos’ Chief Product and Technology Officer, Barb Morgan, recently shared insights on this revolutionary change in digital banking services.

The transformation comes as banks increasingly leverage artificial intelligence to provide personalized, round-the-clock customer support. Morgan, speaking on the NVIDIA AI Podcast, emphasized how AI technology is fundamentally reshaping traditional banking operations, moving beyond conventional applications in fraud detection and risk modeling.

This dramatic surge in AI adoption reflects a broader industry trend toward more intelligent and intuitive banking services. Financial institutions are now deploying sophisticated AI systems capable of delivering hyper-personalized services and real-time insights to customers, marking a significant evolution in how banks interact with their clients.

The impact of AI extends beyond basic customer service functions. Morgan explained that AI systems are now capable of analyzing vast amounts of customer data to tailor financial products and services to individual needs, making banking interactions more meaningful and relevant. This level of personalization was previously impossible with traditional banking methods.

Data security remains a crucial consideration in this digital transformation. Morgan highlighted the importance of robust data management practices in AI implementation, ensuring that customer information remains protected while delivering enhanced services. This balance between innovation and security has become a cornerstone of modern banking technology.

Sustainability has emerged as another key focus area where AI is making significant contributions. Banks are increasingly using AI tools to help both institutions and customers track and reduce their carbon footprints, demonstrating the technology’s versatility in addressing contemporary banking challenges.

The advancement in AI-powered banking services coincides with Temenos’ upcoming presentation at NVIDIA GTC, scheduled for March 17-21, where the company will delve deeper into “Generative AI for Core Banking.” This session promises to provide further insights into how AI is revolutionizing core banking functions.

Industry experts predict this trend will continue to accelerate, with AI becoming increasingly central to banking operations. The technology’s ability to process and analyze vast amounts of data while providing deeper insights and predictions is proving invaluable for financial institutions seeking to enhance their service offerings.

As banks continue to embrace AI technology, customers can expect more sophisticated, personalized, and efficient banking services. This evolution represents a fundamental shift in how financial institutions operate and interact with their customers, setting new standards for banking service excellence in the digital age.

News Source: https://blogs.nvidia.com/blog/temenos-ai-customer-service-banking/